Day To Day Banking

Islamic Banking

Wealth Management

Deals & Promotions

Digital Services

Help & Support

Accounts

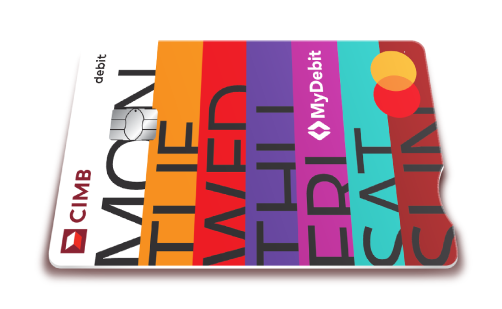

Cards

Financing

More Services

Investments

Insurance/Takaful

Credit Cards & Services

Investment Products

Riuh Durian Runtuh 2026 Campaign

Go for gold and cash prizes worth over RM1.4 million!

Valid until 31st Dec 2026

CIMB Travel Perks

Explore the World with CIMB Travel Perks and unlock rewarding benefits, exciting privileges and seamless travel experience for your next unforgettable adventure

Cash Plus Personal Loan

Get fast approval with CIMB Bank's Cash Plus Personal Loan. Enjoy low interest rates from 4.38% p.a.* and loan amounts up to RM100,000, repayable over 5 years.

Riuh Durian Runtuh 2026 Campaign

Go for gold and cash prizes worth over RM1.4 million!

Valid until 31st Dec 2026

Komuniti

CIMB Kita Bagi Jadi Komuniti is our platform dedicated to economic empowerment, education, and enabling communities to thrive.

Quicklinks

Back

Business

Group

Our Initiatives

Back

Back

Accounts

Riuh Durian Runtuh 2026 Campaign

Go for gold and cash prizes worth over RM1.4 million!

Valid until 31st Dec 2026

Cards

Credit Cards & Services

CIMB Travel Perks

Explore the World with CIMB Travel Perks and unlock rewarding benefits, exciting privileges and seamless travel experience for your next unforgettable adventure

Financing

Cash Plus Personal Loan

Get fast approval with CIMB Bank's Cash Plus Personal Loan. Enjoy low interest rates from 4.38% p.a.* and loan amounts up to RM100,000, repayable over 5 years.

Remittance

Currency Exchange

Sustainability at CIMB

CIMB@Work

More Services

Islamic Banking Overview

Islamic Wealth Management

More Services

Investments

Investment Products

Insurance/Takaful

Latest Promotions

Riuh Durian Runtuh 2026 Campaign

Go for gold and cash prizes worth over RM1.4 million!

Valid until 31st Dec 2026

CIMB Deals

Kita Bagi Jadi

Komuniti

CIMB Kita Bagi Jadi Komuniti is our platform dedicated to economic empowerment, education, and enabling communities to thrive.

CIMB OCTO App

CIMB Clicks

Apply for Products

DuitNow QR

Personalised For You

Customer Help Centre

Locate Us

Rates & Charges

Calculators

Security & Fraud

Extra Care by CIMB

You're viewing:

Personal Banking

Other Sites

Day To Day Banking

Accounts

Cards

Financing

More Services

Islamic Banking

Wealth Management

Investments

Insurance/Takaful

Deals & Promotions

Digital Services

Help & Support

Quicklinks

MY

-

EN